Avoid the Rental Trap in 2023

If you’re a renter, you likely face an important decision every year: renew your current lease, start a new one, or buy a home. This year is no different. But before you dive too deeply into your options, it helps to understand the true costs of renting moving forward.

In the past year, both current renters and new renters have seen their rent go up based on information from realtor.com:

“Three out of four renters (74.2%) who have moved in the past 12 months reported seeing their rent increase. The strain from recent rent hikes isn’t exclusive to renters who have recently moved. Nearly two-thirds of renters (63.2%) who have lived in their current rental between 12 and 24 months, and likely renewed their lease, have also reported increases in their rent.”

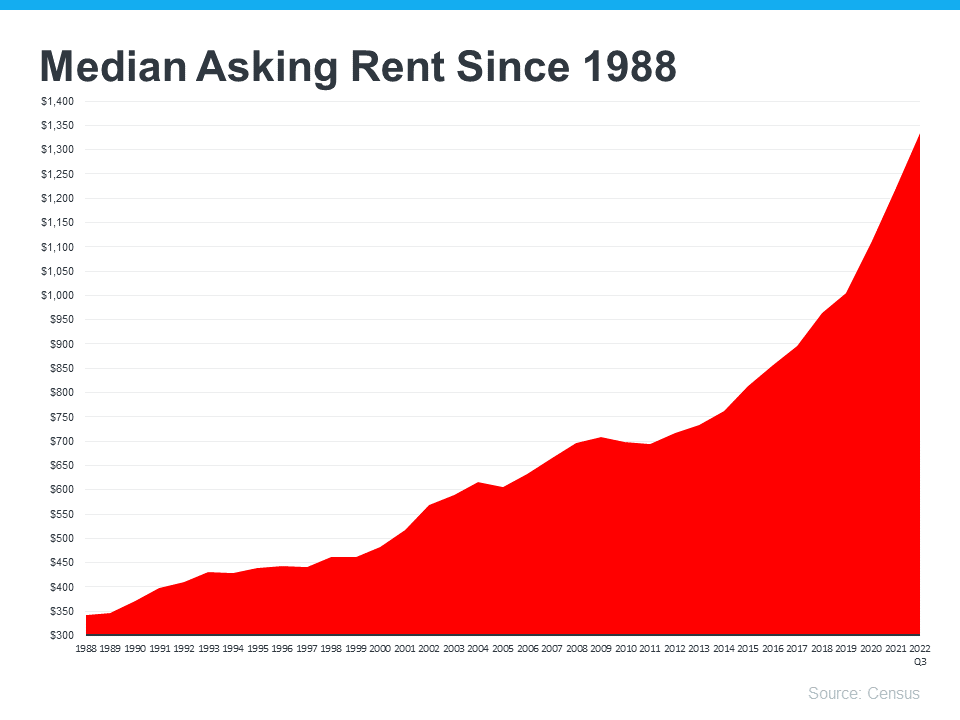

And if you look back at historical data, that shouldn’t come as surprise. That’s because, according to the Census, rents have been rising fairly consistently since 1988 (see graph below):

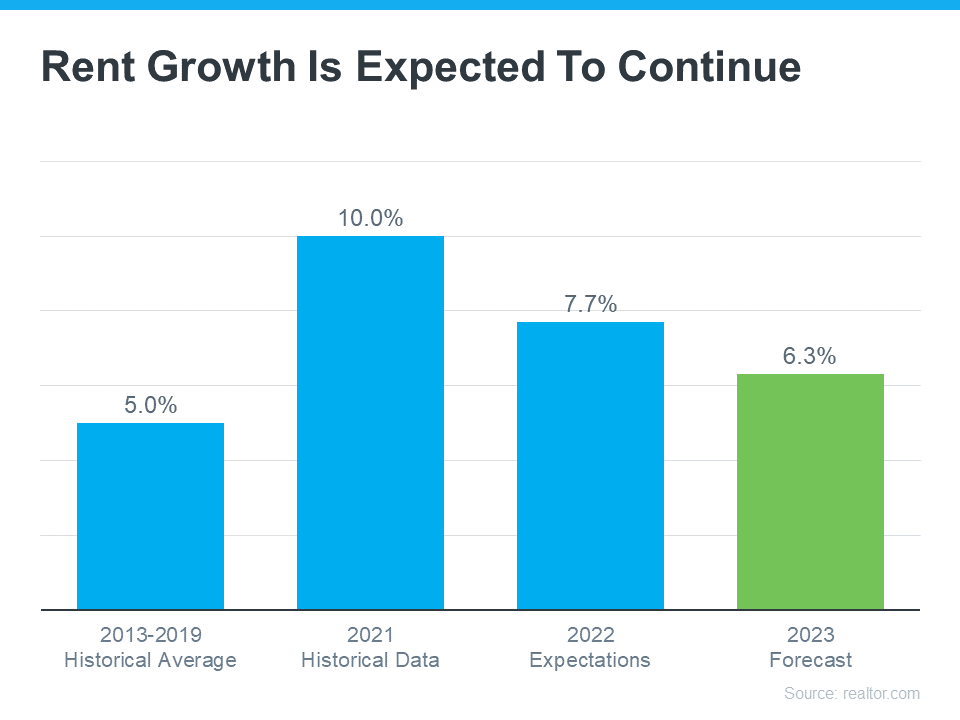

So, if you’re considering renting as an option in 2023, it’s worth weighing whether this trend is likely to continue. The 2023 Housing Forecast from realtor.com expects rents will keep climbing (see graph below):

That forecast projects rents will increase by 6.3% in the year ahead (shown in green). When compared to the blue bars in the graph, it’s clear that the 2023 projection doesn’t call for an increase as drastic as the ones renters have seen over the past two years, but it’s still above the historical average for rent hikes between 2013-2019.

That means, if you’re planning to rent again this year and you’ve not yet renewed your lease, you may pay more when you do.

Homeownership Provides an Alternative to Rising Rents

These rising costs may make you reconsider what other alternatives you have. If you’re looking for more stability, it could be time to prioritize homeownership. One of the many benefits of owning your own home is it provides a stable monthly cost that you can lock in for the duration of your loan. As Freddie Mac says:

“Monthly rent payments may increase over time, but a fixed-rate mortgage will ensure that you’re paying the same amount each month. With a fixed-rate mortgage, your interest rate is locked in for the life of loan. Steady payments allow you to budget wisely and make plans for the future.”

If you’re planning to make a move this year, locking in your monthly housing costs for the duration of your loan can be a major benefit. You’ll avoid wondering if you’ll need to adjust your budget to account for annual increases like you would if you left your housing payment up to your landlord and their renewal cycle.

Homeowners also enjoy the added benefit of home equity, which has grown substantially. In fact, the latest Homeowner Equity Insight report from CoreLogic shows the average homeowner gained $34,300 in equity over the last 12 months. As a renter, your rent payment only covers the cost of your dwelling. When you pay your mortgage on a house, you grow your wealththrough the forced savings that is your home equity.

Bottom Line

If you’re thinking of renting this year, it’s important to keep in mind the true costs you’ll face. Let’s chat to see how you can begin your journey to homeownership today.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link