Are More Homes Coming onto the Market?

An important factor shaping today’s market is the number of homes for sale. And, if you’re considering whether or not to list your house, that’s one of the biggest advantages you have right now. When housing inventory is this low, your house will stand out, especially if it’s priced right.

But there are some early signs that more listings are coming. According to the latest data, new listings (homeowners who just put their house up for sale) are trending up. Here’s a look at why this is noteworthy and what it may mean for you.

More Homes Are Coming onto the Market than Usual

It’s well known that the busiest time in the housing market each year is the spring buying season. That’s why there’s a predictable increase in the volume of newly listed homes throughout the first half of the year. Sellers are anticipating this and ramping up for the months when buyers are most active. But, as the school year kicks off and as the holidays approach, the market cools. It’s what’s expected.

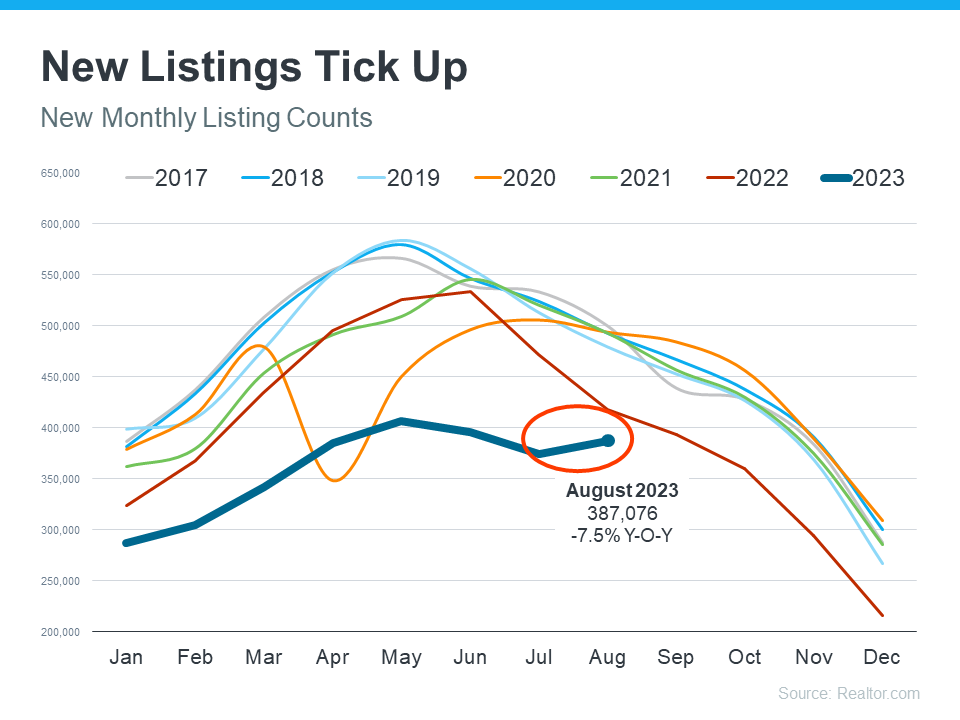

But here’s what’s surprising. Based on the latest data from Realtor.com, there’s an increase in the number of sellers listing their houses later this year than usual. A peak this late in the year isn’t typical. You can see both the normal seasonal trend and the unusual August in the graph below: As Realtor.com explains:

As Realtor.com explains:

“While inventory continues to be in short supply, August witnessed an unusual uptick in newly listed homes compared to July, hopefully signaling a return in seller activity heading toward the fall season . . .”

While this is only one month of data, it’s unusual enough to note. It’s still too early to say for sure if this trend will continue, but it’s something you’ll want to stay ahead of if it does.

What This Means for You

If you’ve been putting off selling your house, now may be the sweet spot to make your move. That’s because, if this trend continues, you’ll have more competition the longer you wait. And if your neighbor puts their house up for sale too, it means you may have to share buyers’ attention with that other homeowner. If you sell now, you can beat your neighbors to the punch.

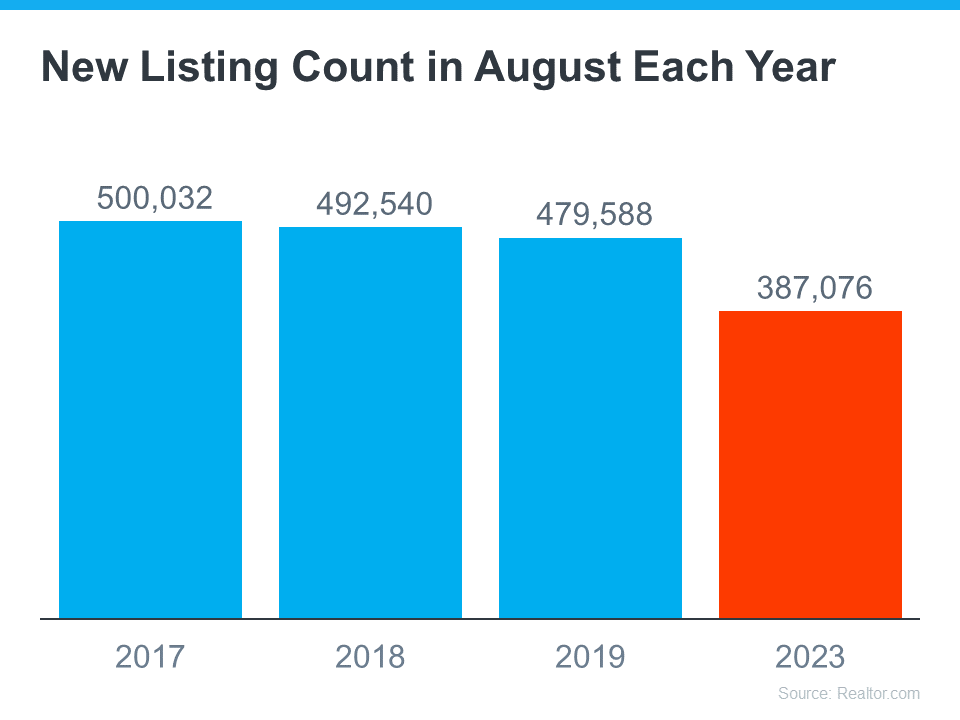

But, even with more homes coming onto the market, the market is still well below normal supply levels. And, that inventory deficit isn’t going to be reversed overnight. The graph below helps put this into context, so you can see the opportunity you still have now:

Bottom Line

Even though inventory is still low, you don’t want to wait for more competition to pop up in your neighborhood. You still have an incredible opportunity if you sell your house today. Let’s connect to explore the benefits of selling now before more homes come to the market.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link